What is Next Gen GST and why should you care?

Picture this: you walk into a store to buy groceries, medicines, or a new appliance, and you pay significantly less tax than before. This is exactly what’s happening with India’s Next Gen GST reform, starting this Navratri season.

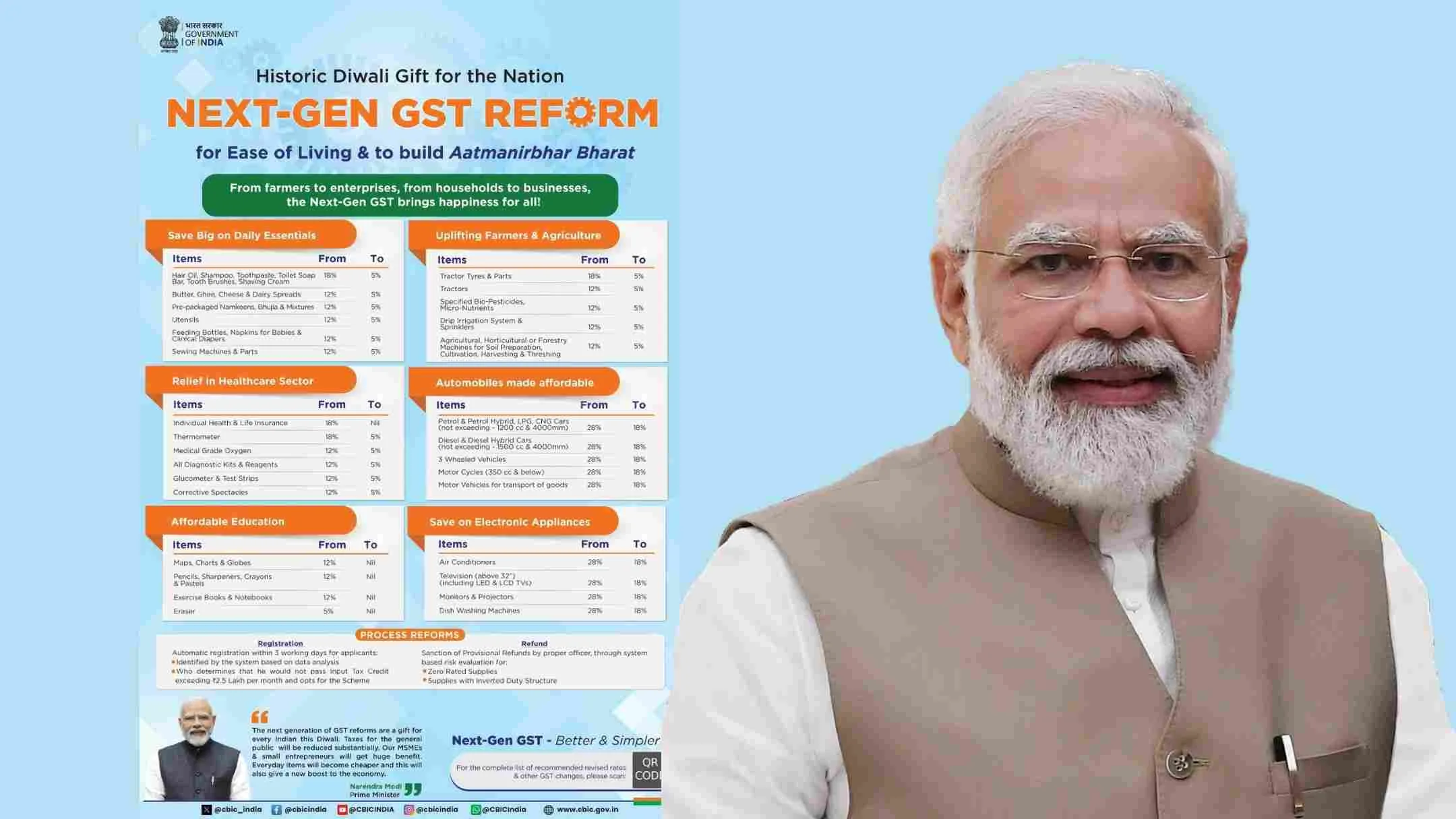

Prime Minister Narendra Modi announced these changes during his Independence Day speech on August 15, 2025, calling it a “big Diwali gift” for every Indian family. After getting formal approval in early September, the new tax rates begin on September 22, 2025.

This matters because it puts real money back in your pocket. Your monthly household expenses are about to get more manageable, and many essential items will cost less than they have in years.

The new system: just two simple rates

The Next Gen GST makes things simpler. Instead of five slabs, we now just have two main categories:

5% for essential items – your daily essentials, medicines, basic household goods 18% for standard products – electronics, appliances, most other items

There’s also a 40% rate, but that only applies to luxury cars, cigarettes, and alcohol.

The best part? Many items that used to be expensive now cost much less. And some important things like life-saving medicines, health insurance, and school supplies are now completely tax-free.

How much money will you actually save?

Let’s look at real numbers that affect your monthly budget:

Your regular shopping gets cheaper

Items that were taxed at 18% Pre GST now cost less under Next Gen GST at just 5%. Think about your monthly spending on personal care products, snacks, kitchen items, or treats for your children. A family spending ₹20,000 monthly on these essentials could save around ₹2,600 every month. That’s over ₹31,000 per year.

Healthcare becomes more affordable

Health and life insurance policies are now completely tax-free. Pre-GST, they used to carry an 18% tax. Additionally, 36 essential medicines for serious conditions like cancer now have zero tax. If you pay ₹20,000 annually for health insurance, you’ll save ₹3,600 immediately.

Education costs drop for your children

All school supplies are now tax-free. Notebooks, pencils, erasers, maps, charts – none of these carry tax anymore. Earlier before GST, parents paid 5-12% tax on educational materials. For families with school-going children, this means savings of ₹2,000-3,000 annually.

Home appliances become accessible

Planning to buy a TV, air conditioner, or refrigerator? Electronics now cost less because taxes dropped from 31% pre-GST to 18%. A ₹50,000 television that previously cost ₹64,000 with taxes will now cost ₹59,000. You save ₹5,000 right away.

Daily items cost much less

Here’s a clear comparison of how tax rates changed for items you buy regularly:

| Item | Pre GST | Next Gen GST |

| Chocolates | 31% | 5% |

| Personal care products | 27-28% | 5% |

| Bicycles | 22% | 5% |

| Bottled water | 27% | 5% |

| Butter and cheese | 12% | 5% |

| Kitchen utensils | 12% | 5% |

| Consumer electronics | 31.3% | 18% |

| Televisions | 31.3% | 18% |

| Cement | 28% | 18% |

| Tractors | 12% | 5% |

| Agricultural machinery | 12% | 5% |

| Luxury/Sin Goods | Pre GST | Next Gen GST |

| Luxury cars, cigarettes, alcohol | 28% + cess | 40% |

| Complete Tax Exemptions (0% GST) | Pre GST | Next Gen GST |

| Essential medicines (36 items) | 5-12% | 0% |

| Health & life insurance | 18% | 0% |

| School supplies (notebooks, pencils, etc.) | 5-12% | 0% |

| UHT milk and paneer | 5% | 0% |

This table shows the dramatic reduction in taxes across categories that matter most to your daily life.

Big relief for farming families

If you have farming connections, this news is especially important. Agricultural equipment that was expensive is now much more affordable:

- Tractors: Tax reduced from 12% to 5%

- Farm machinery: From 12% to 5%

- Irrigation systems: From 12% to 5%

- Tractor tyres & parts: From 18% to 5%

A farmer buying a ₹5 lakh tractor used to pay ₹60,000 in taxes. Now the tax is just ₹25,000. That’s a saving of ₹35,000, which makes modern farming equipment accessible to more farmers.

Why the middle class benefits most

This entire reform centers around middle-class families. Here’s exactly how it helps you:

Lower monthly expenses: Reduced taxes on daily essentials mean your household budget stretches further.

Better healthcare access: Tax-free insurance and cheaper medicines provide financial security when you need medical care.

Affordable education: Zero tax on school supplies reduces the cost of your children’s education.

Home improvements: Cheaper appliances and electronics help you upgrade your living standards without straining your budget.

Business opportunities: If you run a small business, simpler tax rules mean less paperwork and more time to focus on growth.

A typical middle-class family could save ₹30,000 to ₹50,000 annually from these changes. This is money you can use for family needs, savings, or improving your quality of life.

The government’s smart strategy

This reform has three clear goals:

Encouraging more businesses to register: When tax rates are simple and reasonable, more small businesses join the official system. This helps the economy grow and creates jobs.

Making compliance easier: With just two main rates, businesses spend less time on tax calculations and more time serving customers.

Supporting digital processes: The new system works smoothly with online filing and digital payments, making everything faster and more convenient.

How India compares globally

India’s two-rate system is similar to successful models in countries like Singapore and New Zealand. These nations have shown that simpler tax structures lead to better economic growth and higher compliance.

India’s approach is unique because of the 40% rate on luxury items. This keeps essential goods affordable while discouraging excessive consumption of harmful products. It’s a balanced approach that considers both economic growth and social welfare.

What this means for your family and India’s future

The timing works perfectly for families preparing for the festive season. Your Navratri and Diwali shopping will be more affordable this year. You’ll immediately notice the difference in prices for electronics, clothing, gifts, and daily groceries.

Beyond immediate savings, this reform helps the broader economy. When middle-class families have more spending power, they invest more in education, healthcare, and lifestyle improvements. This creates demand for products and services, which leads to job creation and business growth.

For your family, it means easier access to healthcare, better educational opportunities for your children, and a more comfortable lifestyle. For India, it represents faster economic progress with a stronger middle class leading the way.

Getting ready for the change

September 22 marks the beginning of a simpler, more affordable tax system. You don’t need to do anything special to benefit from these changes. The new rates will automatically apply to your purchases from that date.

Keep your receipts and bills to see the immediate difference in your shopping expenses. Many families will notice significant savings within the first month itself.

This reform proves that good policy can directly improve daily life. When taxes are fair, simple, and reasonable, everyone wins. Families save money, businesses grow more easily, and the country’s economy becomes stronger.

The new GST system finally works the way it was always supposed to – making life easier and more affordable for ordinary Indians who work hard and deserve better value for their money.